Services

Fraud control

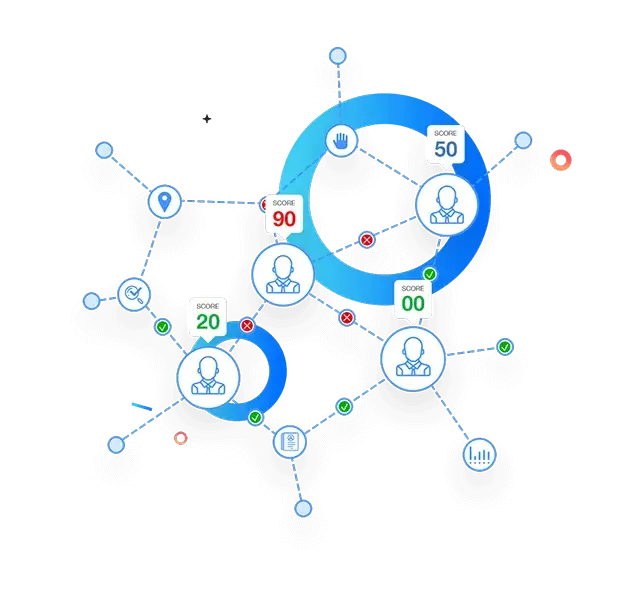

Velocity checks and fraud scoring. Fraud management based on scoring rules and advanced algorithms. Preview the rules in the simulator.

Services

Velocity checks and fraud scoring. Fraud management based on scoring rules and advanced algorithms. Preview the rules in the simulator.

We've developed a flexible, scalable, and intelligent fraud module. Whether you use a team of experts or prefer to automate.

Sell online, worldwide. Offer your customers a fast, smooth and secure payment experience. Improve loyalty and increase sales. If you have an ecommerce business, this is your solution.

Don't miss a sale: adapt to your client and take advantage of the optimal time for conversion. Safely charge by phone or send a payment link by email or SMS. Turn your customer service into additional sales.

Wherever you want to sell, we make it possible. Generate a paid link and share it with your client through whichever channel you prefer: in a marketing campaign, in your blog, by email, or even via social networks.

Secure payments within your call center: your customer types the card number directly on their mobile, without the agent having access to the data.

An innovative solution for managing online payments in marketplace environments. Multi-carrier sales are processed and the transaction funds are distributed among the different merchants.

We simplify the management of funds, payments, and collections between players of any service platform. For digital business models.

Tokenization of cards for hotel reservations: greater security for your business and a better user experience for your customers. Integration with OTA's, PMS, others.